Founded 2015

The Strategic Capital Partner for Global Travel Leaders

Backing the companies digitizing travel’s $9.6 trillion global economy—from fintech solving cross-border payments to AI optimizing yield management across emerging markets

Travel Venture Capital

Travel’s Only Emerging Market Native VC Fund

Travel’s Only Sector-Native Multi-Stage VC Fund

Travel-Native.

Globally Connected.

Growth-Focused.

Growth

Capital

Travel venture capital is more than funding; it’s strategic fuel to win the market. For founders who have achieved product-market fit, our growth capital, from $250k to $5M, is designed to help you capture defensible territory, outmaneuver competitors, and solidify your category dominance.

Strategic

Guidance

We act as your strategic sparring partner. We believe the best guidance comes not from having all the answers, but from asking the right questions. We pressure-test assumptions, illuminate blind spots, and provide an operator’s perspective to help you find the clearest path to growth.

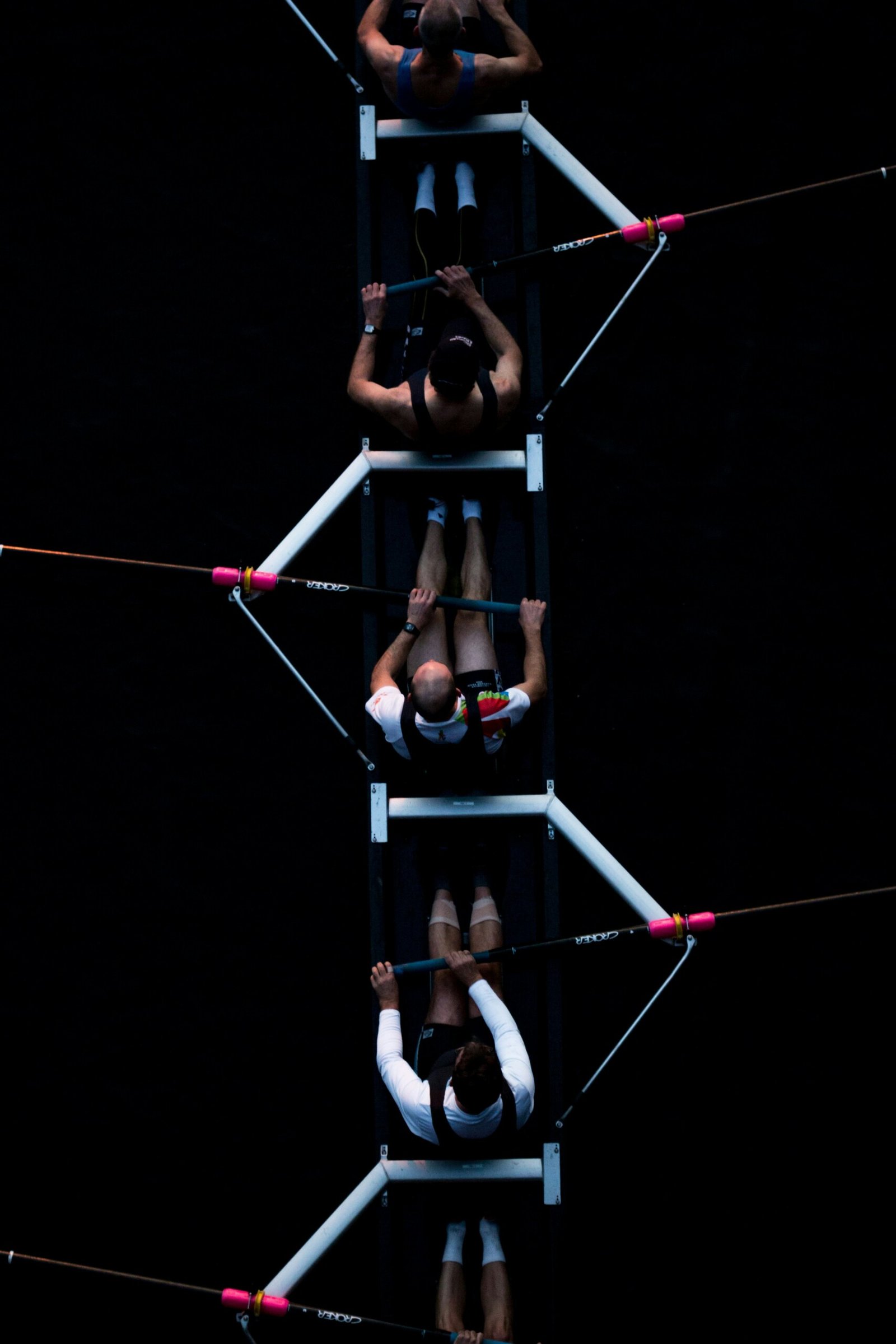

Travel Operators Turned Investors.

A great founder needs more than a financier; they need a guide who knows the terrain. Our team has charted the paths, navigated the complex regulations, and built the very companies you admire. We invest not just as backers, but as experienced navigators committed to guiding your journey from launch to global scale.

.

01

From Founders, For Founders

Our partners and venture partners are former travel executives who have scaled companies in over 50 countries. We skip the industry 101 and provide actionable proven guidance on everything from unit economics to global distribution. This deep-seated expertise allows us to diligence deals more effectively and partner with founders on a level that generalist investors simply can't.

02

The Bridge to High-Growth Markets

While others see complexity in emerging markets, we see our home turf. As market natives, we provide an unparalleled network to unlock revenue and navigate regulations in MENA, Africa, and South Asia. This on-the-ground access provides our companies with an unfair advantage and our fund with proprietary deal flow.

03

Lead Investor with Conviction

We are not a passive check. We lead rounds, take board seats, and provide meaningful follow-on capital because we invest with high conviction. This hands-on approach ensures our founders have the decisive support they need, and our capital is actively managed to maximize outcomes.

Co-Investors

We build powerful syndicates by pairing our sector-native expertise with leading global and regional specialists. Our co-investors are carefully chosen partners who provide our founders with an unparalleled network for global scale.

Our goal is to grow your travel company.

Travel Venture Capital Seed through Series B with checks from $250k to $5M USD.

Our map is global, but our current focus is on high-growth regions we know best: MENA, Africa, South Asia, and Turkey.

Yes. We lead with conviction and are prepared to be your most committed partner

Visit https://travelcapitalist.com/funding/ to submit your company pitch deck, financials and investor materials.

Yes. we partner with founders in all business models—B2B, B2C, or B2B2C. While many travel funds focus on the consumer-facing journey, our distinct expertise lies in guiding companies through the complex B2B travel ecosystem. This is a journey we know well, as B2B companies currently make up about 75% of our portfolio.

A team of travel industry and business executives with a combined 60 years experience in addition to 20 venture partners available to our investments.